Why we recommend Xero:

Real Time information – You’ll have instant access to your data, which will help you make better informed business decisions.

Your accountant is connected – Your Orange Genie accountant can also see all your information in real time, which helps us to support you quickly and effectively.

Accessible on the go – Full access from any device, wherever there’s an internet connection.

All your documents saved in one place– Paperless accounting saves you money, time and trouble

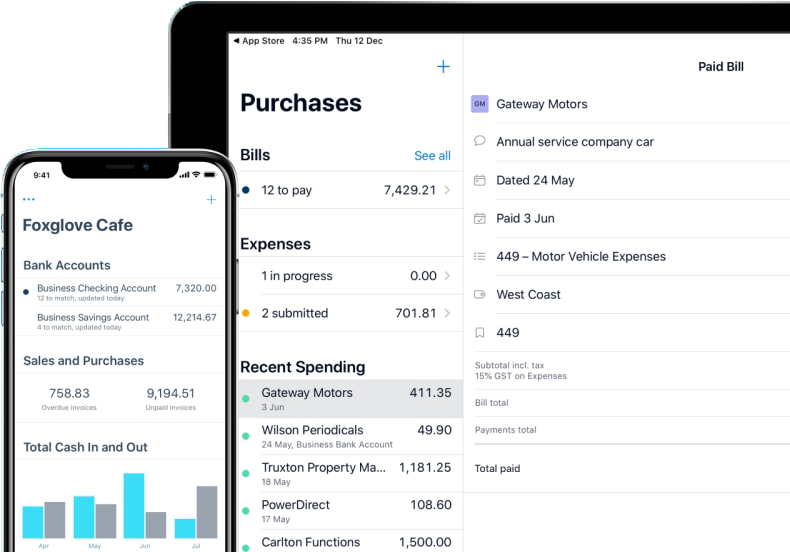

Use Xero on the go!

You can download the free app from the App Store or Google Play. This makes it even easier to manage your business from your smart device:

See your cashflow in real time

your bank transactions in one tap

Send invoices and quotes on the go

See purchases and details to keep on top of your spending

Attach documents to invoices and more

FREE XERO SWITCHOVER

If you need to switch from your existing accounting software to Xero, your Orange Genie Accountant will help you to switch at no additional cost, which could save you over £300.

All Orange Genie small business clients benefit from our free Xero switching service and support. If you have questions about Xero or if we can help in any way, please call our expert team on 01296 468483 or email info@orangegenie.com

All Orange Genie small business clients benefit from our free Xero switching service and support. If you have questions about Xero or if we can help in any way, please call our expert team on 01296 468483 or email info@orangegenie.com