The key to a successful closure of your limited company is to make sure it is done the right way, minimising your tax bill and maximising your gains. In this guide, we’ll explain the options and help you decide which route is best for your circumstances.

Closing your limited company down

You have decided that now is the right time to close your company. Unfortunately, this isn’t as simple as ceasing trading and closing down your business bank account, there are a few formalities to complete and the key to a successful closure is to make sure that it is done in the right way, minimising your tax bill.

To close a company, you must either go through liquidation or a simple strike off of the company. In order to determine which route is right for you, we need to take into consideration the total value of your assets and funds at your cessation date.

Strike off Process

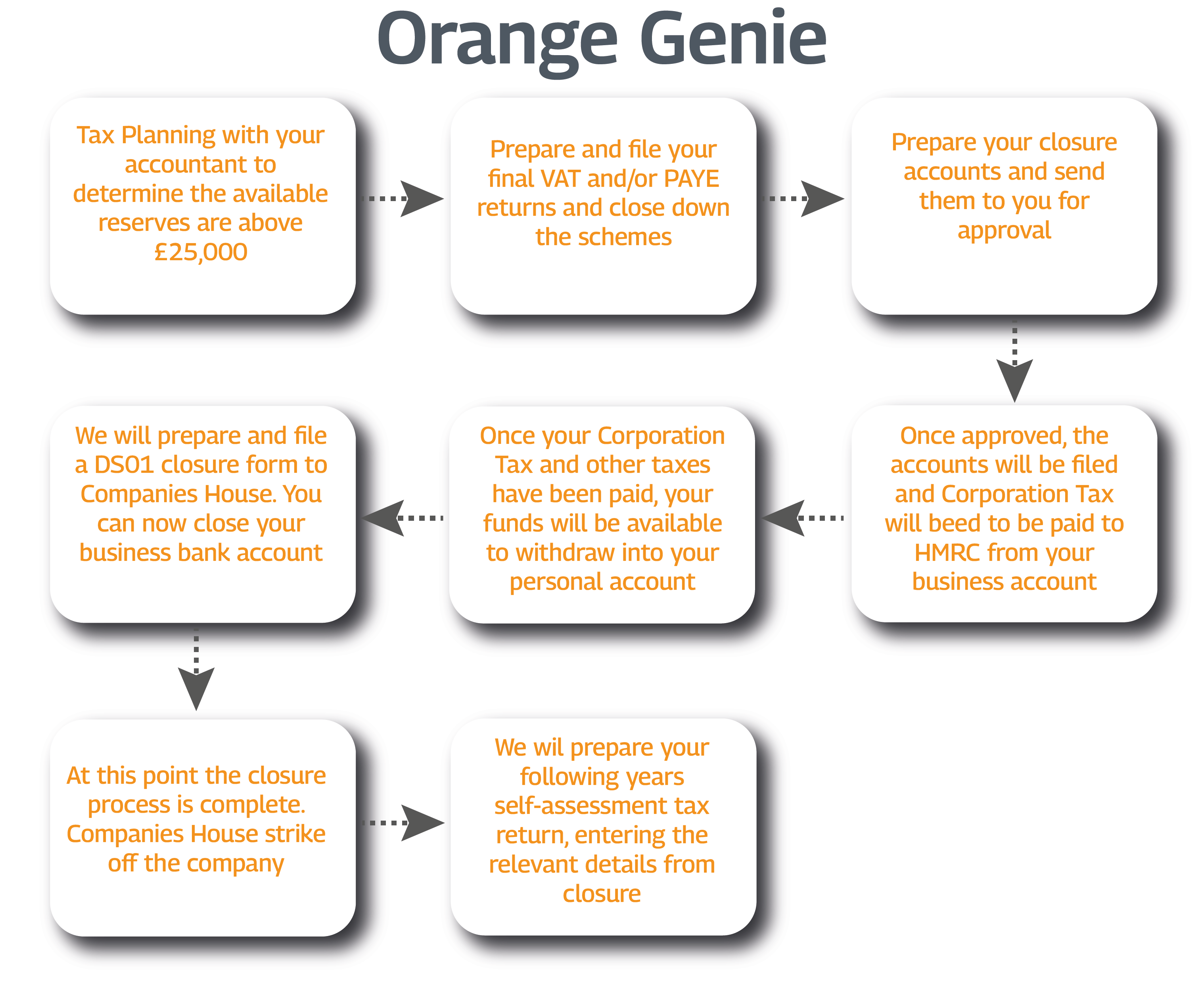

If the total value of assets and funds to be distributed is less than £25,000 then you can close your company down via a simply strike off. The amounts distributed will be treated as a Capital Gain and Entrepreneurs Relief may be available. If this route is followed, Orange Genie Accountancy will prepare cessation accounts for your company and will ensure that you complete all final returns and deregister for all relevant taxes. We will report the distribution of assets and funds on your self-assessment tax return and make sure that the Company is struck off from the Companies House register.

This whole process can take between 3 and 6 months to complete, depending on how quickly your books and records are up to date and documents are retuned to us.

What does that process look like in practice?

Members Voluntary Liquidation

Members Voluntary Liquidation

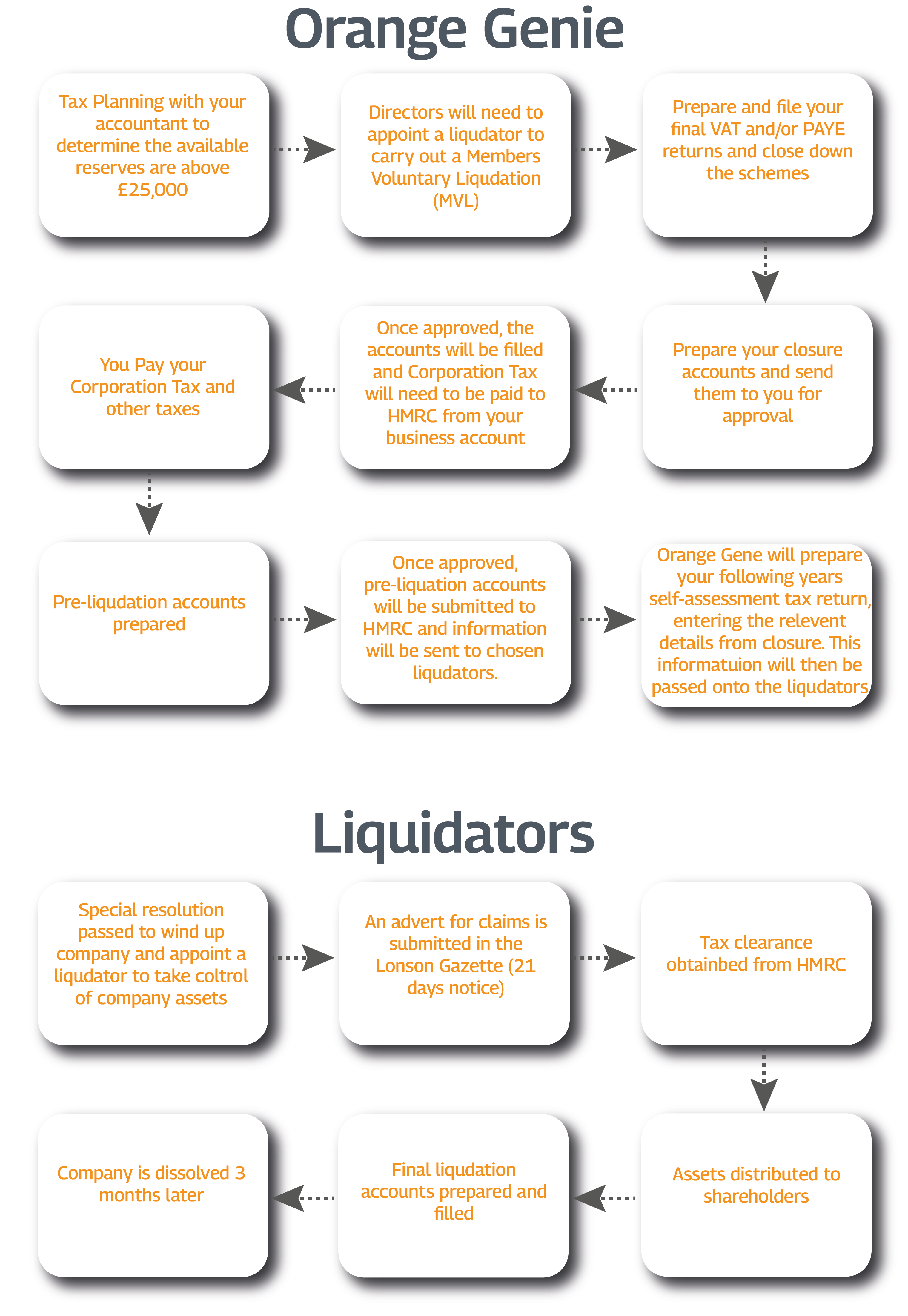

If your company has assets and funds in excess of £25,000, you will need to follow a more formal liquidation route (an MVL) and this must be overseen by an Insolvency Practitioner. Orange Genie Accountancy are not registered Insolvency Practitioners but we have an established relationship with Opus Business Services Group, who are registered to oversee such liquidations. We work closely with them to prepare your cessation and liquidation accounts. We will also complete your final self-assessment once the liquidation is complete. There are higher costs involved with an MVL but these are usually more than exceeded by the tax savings available on your final distribution.

If the value of your assets and funds are marginally higher than £25,000, we can advise on whether the tax saving from an MVL will exceed the fee required to take this option. If it does not make financial sense, Orange Genie Accountancy can work with you to make alternative, more tax efficient plans. Assuming your income in the year has already or will exceed the higher rate threshold, we calculate that for any distributions in excess of £36,000 the appointment of a liquidator is likely to yield the highest return, after having paid all taxes and professional fees. This assumes that Entrepreneur’s Relief is available on the Capital gain.

What does the liquidation process look like?

If you have any questions or if we can help in any way, please contact our expert team on 01296 468 483 or emaill info@orangegenie.com.

If you have any questions or if we can help in any way, please contact our expert team on 01296 468 483 or emaill info@orangegenie.com.