Since IR35 reform hit the private sector in April 2021, we have seen more and more end clients taking control of how they engage with contractors.

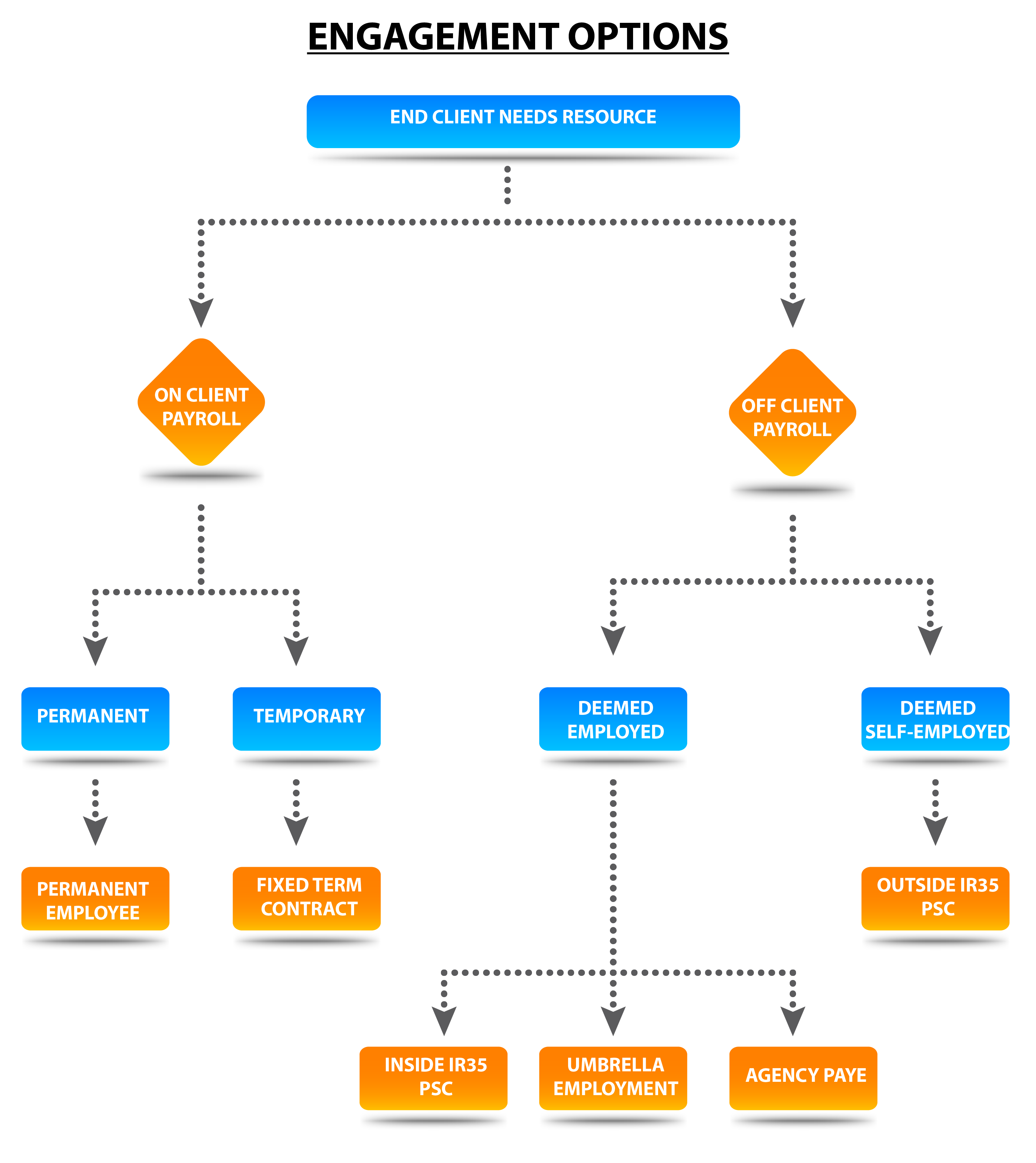

As a contractor, it’s important to understand the various engagement options, so you can navigate this new landscape. Businesses will have varying policies regarding which options they’re prepared to use, so not all end clients will be willing to offer all of these options.

If you’re deemed to be outside IR35

If you’re deemed to be outside IR35

It’s safe to expect that any client who has completed an IR35 assessment and found you to be outside IR35 will be happy to engage with your limited company (PSC). For those who are able, this is still the best way to operate.

Even though your client is responsible for determining your IR35 status, it's still important to follow best practice and gather evidence to support your “outside” position.

If you’re deemed to be inside IR35

Theoretically, it would be possible to continue trading through your PSC, even if your client has determined that you’re inside IR35, and if this is a short-term situation you might want to. However, this relies on the fee payer (whoever pays your PSC, usually an agency or the end client) being willing and able to deduct PAYE tax and NICs.

This is not an ideal situation for you in the long term, as you’ll have to pay PAYE tax and NICs while having no employment rights and still incurring the costs of running your company.

Umbrella employment

This is usually the best option for those who are deemed to be inside IR35. The umbrella company will take the place of your PSC in the supply chain, employing you and supplying your services to the agency or end client. All your pay will be treated as salary, and you’ll be paid through the umbrella company’s payroll.

As an employee, you’ll have the rights, protections and benefits UK law provides to employees, including paid holiday, statutory payments like sick pay and maternity/paternity pay, and access to a workplace pension.

Agency PAYE

If you’re engaged through a recruitment agency, you may have the option to be paid via their payroll.

Opting for agency PAYE usually means you’ll be engaged separately for each contract. This succession of short engagements gives you limited employment rights while you’re working, and no rights at all when you’re between contracts. Given that your take home pay will be roughly the same, umbrella employment is usually the better option if you have the choice.

Contracting as a sole trader

While there may be some opportunities for contractors to be engaged as sole traders, these are and will remain few and far between. Most end clients want to have a legal entity, like a PSC or umbrella company, between them and the contractor. This protects them from additional liabilities, for example if the contractor doesn’t pay the correct tax, or attempts to claim employment rights.

Contracting as a sole trader can be risky for contractors as well, as there is no limited liability or separation between personal and business assets. This could leave your home or other property at risk, particularly in litigious sectors where you might be sued by a client.

Direct employment

You may have the option to be directly employed by the client, either on a permanent basis or a fixed-term contract. Most contractors chose contracting because the autonomy and flexibility it offers was important to them. When deciding whether to accept an offer of direct employment, you should also consider whether that is still the case for you, and weigh the offer against the prospect of losing that freedom.

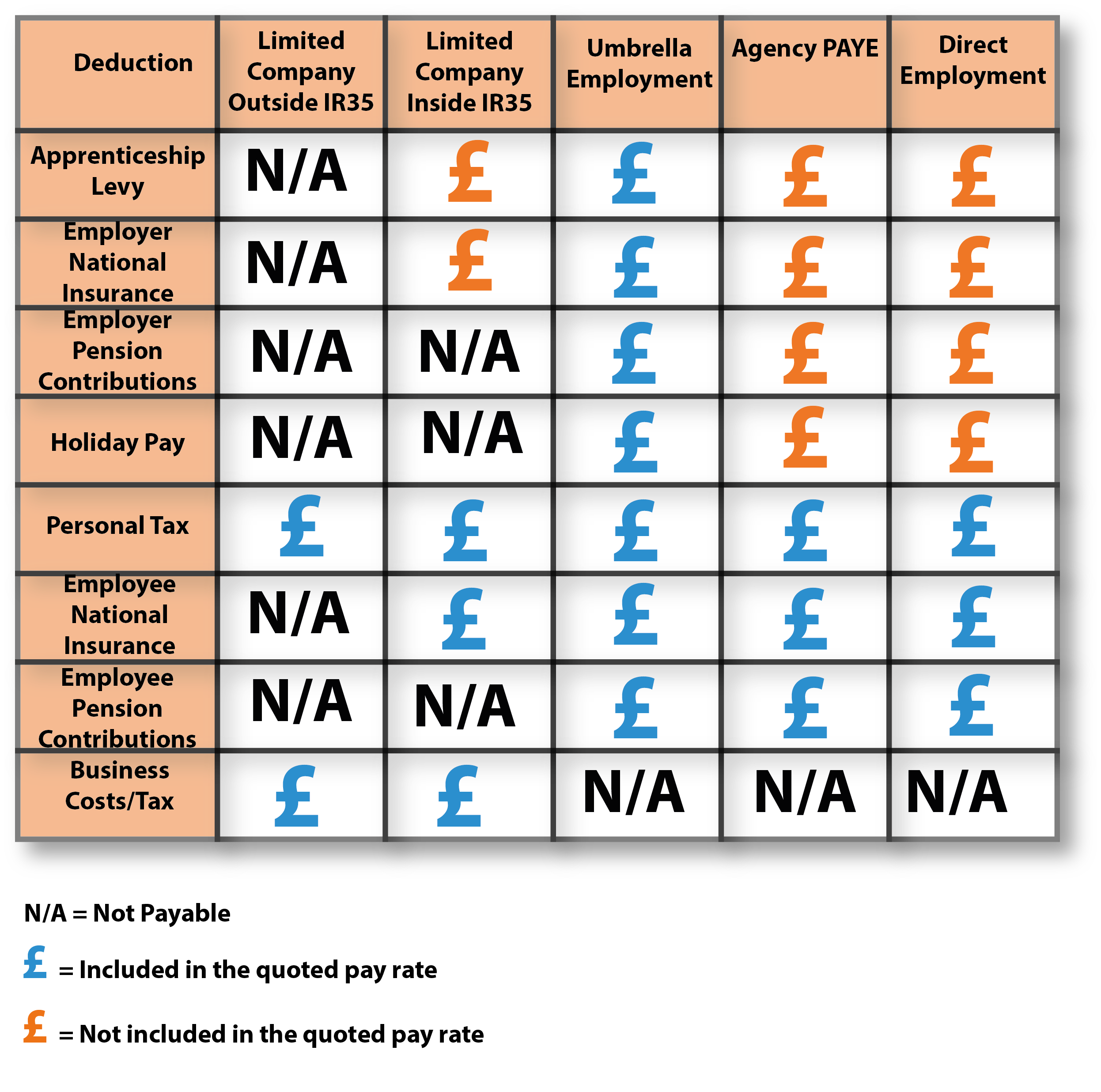

What’s included in the agreed rate?

Depending on the engagement type, certain things will be included or excluded from the agreed contract rate, and it’s important to know what they are so you can effectively choose between them, or compare contracts where the engagement type will be different. Often the client or agency will quote a different rate, depending on the engagement type and which deductions are included.

How the engagement method affects your take-home pay

How you’re engaged may affect the amount of money you take home. For example, if you’re outside IR35, trading through your limited company allows you tax-planning opportunities that are not available to employees, so you’d expect to take home more money if the rate was the same.

Conversely, you’d expect to take home less money trading inside IR35 through your limited company, because those tax planning opportunities would not be available, and you’d have to pay the costs of running your company out of taxed income.

If you have any questions or if we can help in any way, please call our expert team on 01296 468 483 or email info@orangegenie.com.