From April 2021, responsibility for determining IR35 status was taken out of contractors’ hands, and pass to the hirer (end client). This gives end clients new responsibilities, but the changes affect recruiters as well. There is still confusion about where responsibility sits supply chains, so in this article we’ll try to clear that up.

How the supply chain relates to IR35

Before we can clearly explain how IR35 affects the various members of the supply chain, we need to address the issue of what it calls them. The legislation uses a number of terms to identify where responsibilities sit, and it’s important that we know who they mean.

For the purposes of this explanation, we’ll assume a simple supply chain where you are the only recruiter involved and the contractor is trading through their own limited company (PSC). The important labels are:

The Hirer – this is your client, the party who receives the services supplied by the contractor

The intermediary – this the contractor’s PSC.

The fee payer – this is you, the party who pays the intermediary.

The worker – this is the contractor.

Where there is more than one recruiter involved, the Fee Payer is whoever pays the intermediary. This is important because the Fee Payer has specific responsibilities if the worker is inside IR35.

Outside IR35 determinations

Where the client determines that the IR35 rules do not apply - that the contractor is “outside” IR35, the payment of tax and NICs remains a matter between the contractor and their PSC.

The client is responsible for communicating their decision and the reasons for it to all stakeholders, including you and the contractor.

If the outside determination is later found to be incorrect, liability will ultimately rest with the client, as everyone else acted according to their instructions.

This is why some end clients have taken an apparently risk-averse stance, and are either determining all contractors to be inside IR35, or refusing to engage PSCs. This strategy has its own risks, as it makes recruitment of contractors more difficult, while increasing the cost of paying them. This is why it’s so important to ensure your clients get good advice, and determine IR35 status correctly.

Inside IR35 determinations

Where the client determines that the IR35 rules do apply – that the contractor is “inside” IR35 – they are again responsible for communicating their decision and the reasons for it to all stakeholders.

As the Fee Payer, you must then deduct PAYE tax and NICs from any payments made to the intermediary. You must also pay employers NI.

In this case, where the correct tax and NICs are not paid, liability lies with you as the party responsible for making deductions and paying them over to HMRC.

However, in most cases we would not expect this situation to arise, because the contractor will usually be better off using a PAYE solution, like an umbrella company, rather than trading through their PSC.

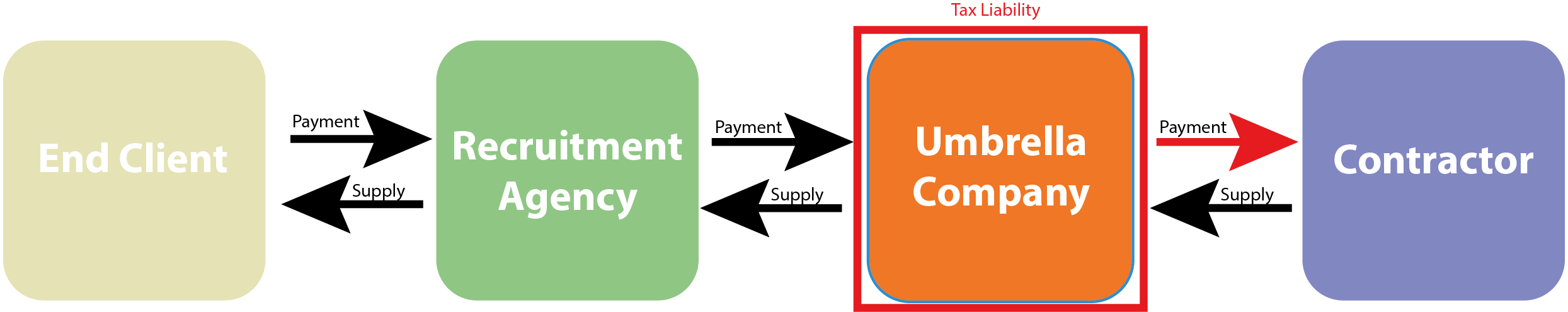

Where the contractor is employed by an umbrella company

Where the contractor is employed by a compliant umbrella company, the contractor’s employment status is no longer in question and the IR35 rules are not applicable. The umbrella assumes all the legal responsibilities of the contractor’s employer, including deduction and payment of PAYE tax and NICs. In the unlikely event that the correct tax and NICs are not paid, the umbrella company has liability.

The contractor is paid roughly the same as they would be through their PSC if they were inside IR35, but they don’t have to cover the costs of running their company. They also receive the rights, protections and benefits of employment, which they otherwise would not have access to.

PLEASE NOTE: You do still have a responsibility to ensure the umbrella company is compliant, and failure to take “reasonable steps” could leave you facing charges under the Criminal Finance Act if an umbrella in your supply chain breaks the law. |

If you have questions or if we can help in any way, please call our expert team on 01296 468 483 or email info@orangegenie.com.