Contractor and Freelancer Services

Contractor and Freelancer Services

Contracting is a lifestyle choice, as well as a specialist business model, and you need an accountant who understands the nuances and knows where you will need their support.

You also need your accountant to be familiar with the complex legislation that affects the contracting industry and keep up to date with the fast pace of change.

In other words, you need a specialist contractor accountant who can give you and your contracting business the time and attention you deserve.

As a client of Orange Genie Accountancy, you’ll be supported by a dedicated specialist accountant from our contracting team. Your accountant wants to understand your business and will focus on the details that make a difference to you and your success.

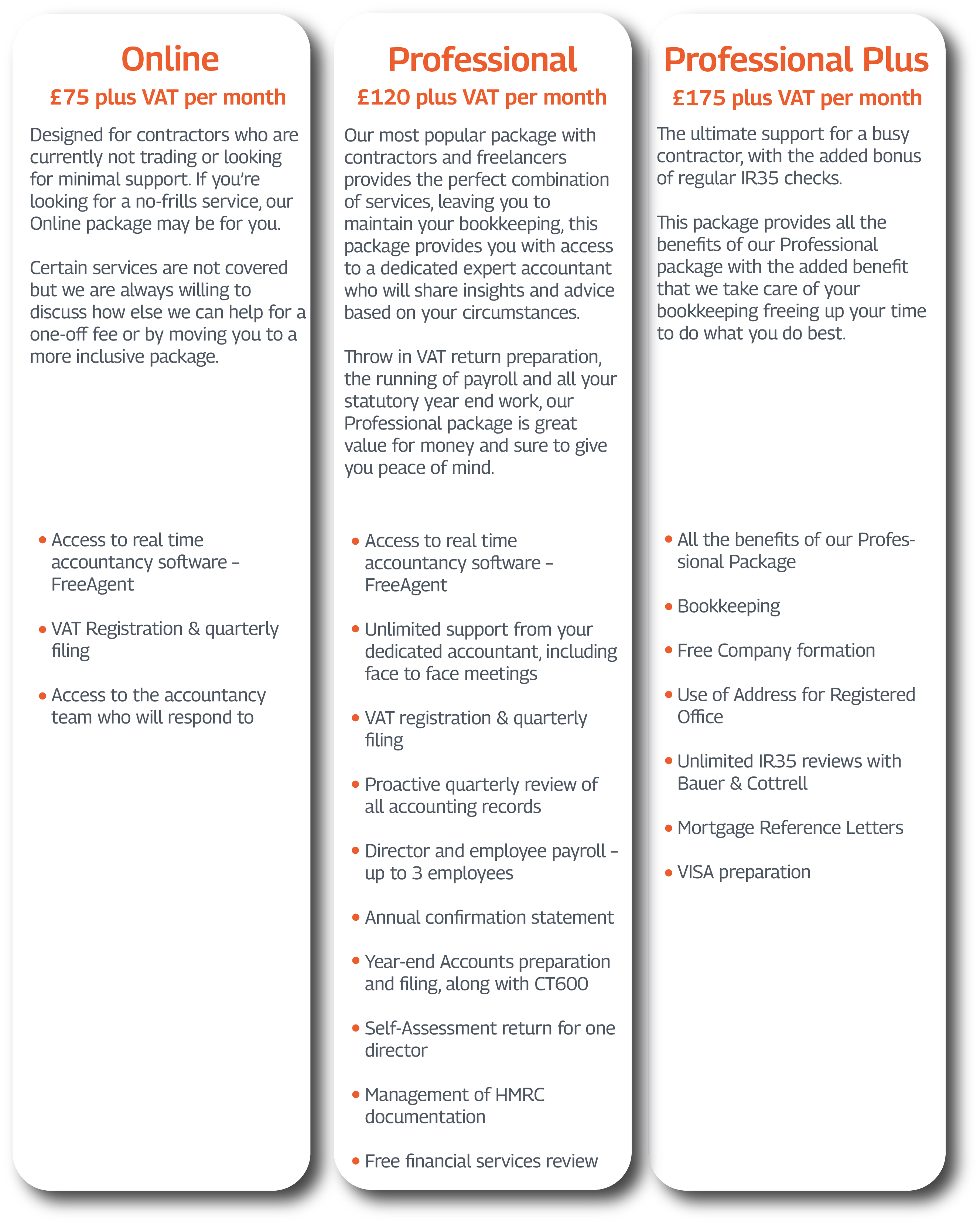

We understand that one package may not suit everybody, so we offer three different fixed fee packages.

Why do you need an accountant?

Why do you need an accountant?

Orange Genie Complete

Orange Genie Complete allows our Accountancy clients to switch to umbrella employment and back again, as many times as necessary and at no additional cost. This can be extremely useful if your IR35 status changes from contract to contract, which is more common since the rules changed in April 2021.

The transition is handled internally making it completely seamless and allowing you to choose umbrella or limited on a contract-by-contract basis. It also gives our accountants the full story, ensuring tax planning is long term, effective and above all, in your best interest.

For Orange Genie Complete clients there is no umbrella margin, so you only pay for your accountancy package. This means you’re always using the best model for your circumstances, even if those circumstances change on a regular basis.

On the surface, doing your own accounts might look like a good way to save money but unless you’re an accountant yourself it’s unlikely to work out that way. Here are the most important reasons why it’s important to engage a specialist contractor accountant to help you run your Limited company.

Specialist expertise

You wouldn’t attempt to carry out a major structural extension on your home (unless you’re a builder) or provide medical and dental treatment to family members if you’re not qualified to do so. It’s no different with accountancy and tax advice. Your company is more than a series of admin tasks, and your accountant’s expertise adds value beyond maintaining your books and records. A good accountant will pay for their fee, often many times over, by saving you money and helping you grow your business.

Your time is valuable

Each year dozens of tasks need to be completed, including: Calculating and paying your PAYE and National Insurance, submitting your VAT returns, preparing and submitting Company accounts and tax returns to HMRC and Companies House, calculating your personal tax situation, dealing with HMRC and Companies House queries and filing a confirmation statement.

Many of these tasks come with deadlines that you’ll need to keep track of, and you can incur fines and penalties if you miss them. All this is on top of the bookkeeping and the time you might need to invest in researching any queries you have, and you still won’t know if you missed something an expert would have spotted and paid more tax than you needed to.

Handing these tasks off to your accountant not only leaves them in expert hands, it also frees you up to focus on what you’re good at.

Legislation often changes

How you maintain your records one year may not be the same as the next. You need to be abreast of new legislation, and that can be a real challenge if you’re not already an expert. Your specialist contractor accountant will not only be aware of the changes as they are announced, they will help interpret and apply the rules, ensuring you and your company are always compliant.